FOREWORD BY DR. MIKE: A big portion of CoachLancer members and webinar participants come from Nigeria where making international payments online is not a common thing. So, we called the CoachLancer community for help. Chukwuka Deh compiled the list presented in this article to make sure that at least Nigerian freelancers will not need to struggle in making online payments anywhere. Getting a virtual dollar card in Nigeria in 2023 is actually a no-brainer!

Please see the social proof for using every credit card mentioned here in the call-for-support post I made on LinkedIn. Many of my friends use these platforms for integrating into the global gig economy.

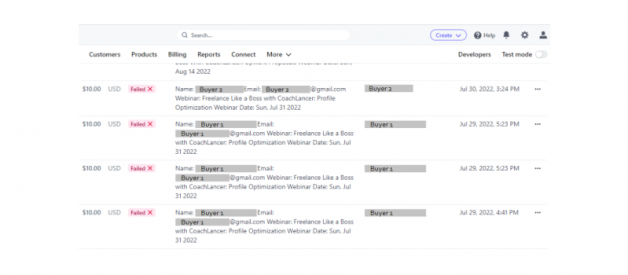

A typical sight of the Freelance Like a Boss Course registration transactions in 2022.

It’s no news that Nigerian freelancers struggle gravely to receive payments for their hard-earned money. What’s worse? Making payments internationally. The emergence of virtual dollar cards in Nigeria appeared to have solved this issue. Unfortunately, not all of these cards work.

Just over a year ago, the Nigerian government banned and limited making payments over $20 with our local bank cards. This was a huge blow in the face of many, who were originally able to pay for items with their cards.

For freelancers, this news was devastating! Those who needed to get work tools, and courses, and register for international webinars, were completely thrown in the tunnel with no end in sight.

As this news circulated, more local banks in Nigeria began limiting access to their dollar cards. Trust me when I say, getting one of these dollar cards in Nigeria was extremely difficult.

All this negativity begs the question, how on Earth are Nigerian freelancers still active in the international scene?

Well…

Here’s the good news.

There are quite a few platforms (companies) offering virtual dollar cards to Nigerians. These cards can be used to receive as well as make payments internationally.

Let’s get right into them, shall we?

Platforms that offer a virtual dollar card in Nigeria

Chipper Cash

Chipper Cash is probably the go-to platform now when it comes to getting virtual cards in Nigeria. Chipper Cash allows Nigerians access and complete online international payments as well as national payments.

Getting this virtual dollar card in Nigeria is relatively easy. All you have to do is create an account with Chipper Cash and download their app.

Once you’ve done this, you can go ahead and request a card.

Chipper Cash makes life a little easier for Nigerian freelancers by offering them the opportunity to request not just a virtual dollar card but also a Naira card. Once users are verified (usually with BVN and NIN), they get their cards.

The only real drawback with using Chipper Cash is the limit system. You can’t deposit above $1,000 to your card daily, and neither can you withdraw more than $1,000 daily.

Considering how desperate Nigerian freelancers have become in their search for virtual dollar cards, this is nowhere near a ‘drawback’.

Geegpay

Geegpay is yet another wonderful platform that came to the aid of Nigerian freelancers seeking virtual dollar cards. As a product of Raenest targeted at Africa’s international online workers, Geegpay lets you generate invoices as well as receive payments easily.

Geegpay offers a fully functional virtual dollar card as well as a USD account. To get this card, you’d have to be verified on the platform. The verification process requires the following;

- Employment offer

- Occupation

- Proof of address

- Proof of identity

- Employer details

At the end of the verification process, you’d be charged $2 and granted a virtual dollar card to use anytime you like.

Gomoney

Gomoney is a unique and quite reliable digital bank in Nigeria. It’s almost the same as Kuda but seems to be more functional because of its special offerings.

These special offerings include provisions for peer-to-peer payment as well as third-party services and a functional virtual dollar card. Like Chipper Cash, Gomoney allows Nigeria’s digital earners to access both virtual dollar cards and local cards.

To access these cards, you just have to register with the platform and get verified. The verification process requires only your BVN and NIN. Gomoney operates a tier-level system (3 levels). The more verified you are, the higher your level, and of course, the more benefit you’d enjoy.

Payday

Payday is the newest among all of these platforms. This digital FinTech app lets you send and receive money around the world in a matter of minutes.

To access Payday’s virtual dollar card as a Nigerian freelancer, you need to download the app, register, and get verified.

There’s a $5 charge when getting a virtual dollar card from Payday. While this might sound like a drawback to many, there’s absolutely no limit on the virtual cards once accessed.

Alternative Virtual Dollar Cards

Nigerians are naturally skeptical. Maybe due to the happenings around us. So, if you’re not keen on getting a virtual dollar card from any of the above-listed, there’s a simple alternative.

Some local banks still offer dollar cards.

Surprised?

I hope not!

Understand that some major local banks such as UBA, Firstbank, Zenith, Fidelity, etc., offer their customers dollar cards on request.

All you have to do is step into any major bank and ask if they have dollar cards. The requirements to get one are not tedious either.

They’d request one or all of the following:

- Your NIN and BVN

- NEPA Bill

- Working Status (occupation)

- Current account holder’s signature

Within 14 days, you should be holding a brand new dollar card authenticated for all international payments.

As a Nigerian freelancer, your battles to get high-paying clients and quality contracts should remain the only fight you have to make. Receiving and making international payments shouldn’t be part of it!